In a slow, grinding summer for the markets, one investor's name kept popping up: Carl Icahn.

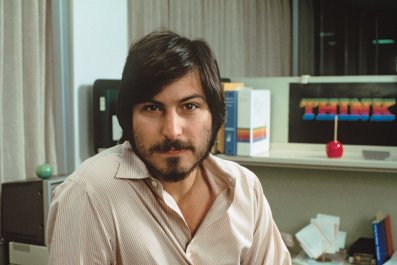

Deep into his eighth decade, Icahn, a 1980s-era corporate raider, has transformed into a social-media-savvy scourge of entrenched management. Icahn, 76, is possessed of deep pockets (his stake in the eponymously named investment vehicle Icahn Enterprises is worth about $7 billion) and a mordant wit. His routines at investor conferences are half Borscht Belt shtick and half disquisition on the structural problems of board governance at large U.S. companies.

This year, Icahn has further raised his profile by publicly injecting himself into several high-profile corporate tussles—often going toe-to-toe with other billionaires. When Michael Dell, the founder and chief executive officer of Dell Computer, proposed taking the struggling PC maker private, Icahn stood up and essentially accused Dell, his partners, and the company's board of playing the public shareholders for chumps. After Icahn rallied shareholders to oppose the deal, Michael Dell in early August boosted his offer. Icahn's response? "The war regarding Dell is far from over."

Earlier this year, Icahn jumped into another swirling stock controversy: the battle over dietary-supplement company Herbalife. After hedge-fund manager William Ackman made a highly public, detailed case for shorting the stock (i.e., betting it would go down), Icahn took the other side of the trade. He bought a big position in the company, argued it was undervalued, and got into Ackman's face (and head) in an epic CNBC segment in January. Ackman, Icahn said, was "like a crybaby in the schoolyard." Throughout the spring and summer, Icahn has been vindicated. As other investors piled in after Icahn, the stock has surged, filling Icahn's pockets (he's up several hundred million dollars on the Herbalife bet) and emptying Ackman's.

But Icahn's most impressive feat may have been a short bolt of prose in the slack days of mid-August. The stock of Apple, once the darling of investors, fell about 40 percent between September 2012 and May 2013, from a high of $700 to below $400. Investors began to urge Apple, which is sitting on a cash pile of $145 billion, to pay higher dividends or buy back stock—moves that would help push shares higher. Apple generally ignored such pleas. Given the company's size, after all, it's very difficult for any one investor to amass a stake large enough to have an influence in the boardroom.

But Icahn is a different creature among investors. After acquiring a small stake, he began to make his presence known. On the afternoon of August 13, Icahn tweeted: "Had a nice conversation with [Apple CEO] Tim Cook today. Discussed my opinion that a larger buyback should be done now. We plan to speak again shortly." Before the tweet, Apple's stock traded at $475. A few minutes later, it had surged to $485, and the next day Apple's shares pierced the $500 barrier for the first time in nearly a year. The company's value, in other words, surged about $22 billion on the news that Icahn would be pressuring Apple's board to part with some of its cash.

It's hard to remember a time in recent memory when one character accomplished so much with 140 characters.