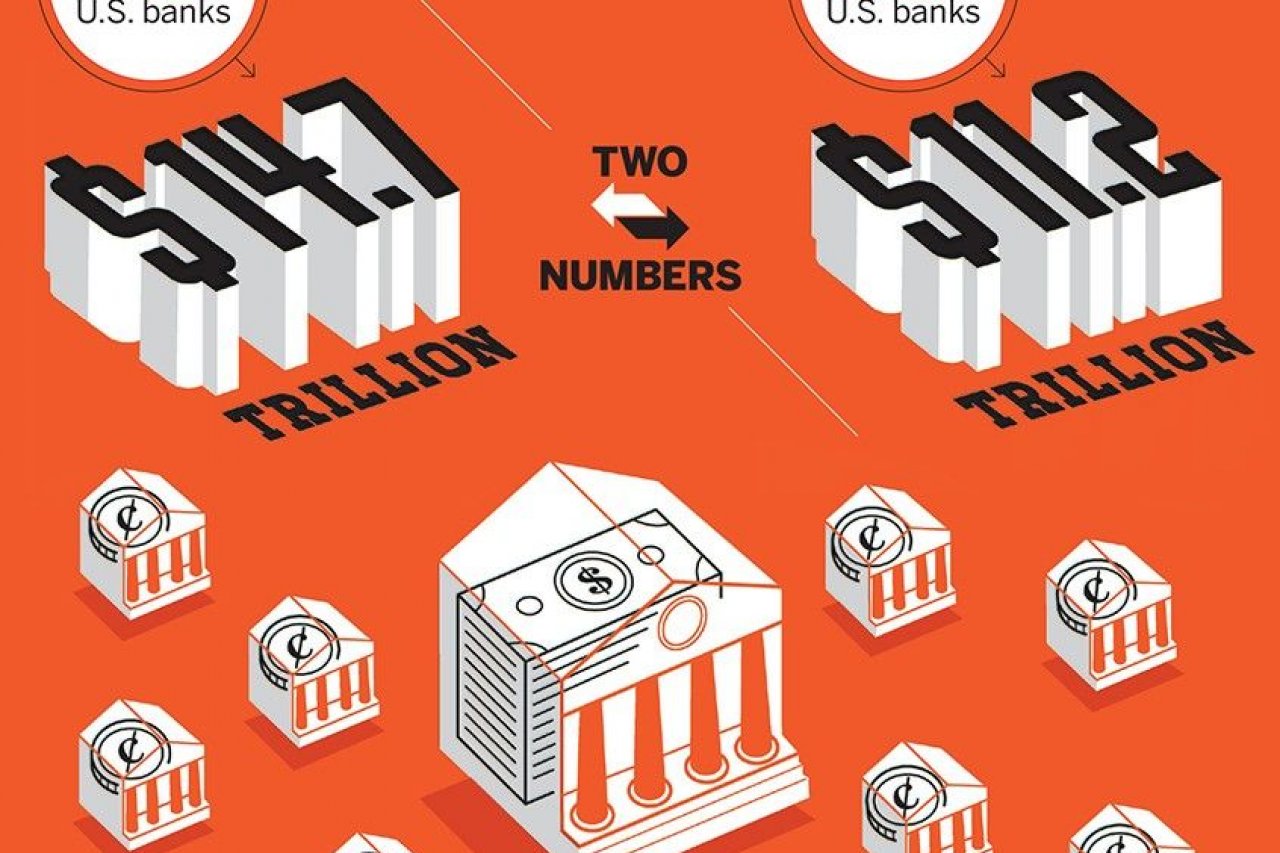

The 1 percent phenomenon is not isolated to the highest income earners in the United States. The trend of a growing concentration of wealth is occurring in other parts of the economy too. Take banks, where the top 1 percent—a mere 68 out of close to 7,000 nationwide—now controls three quarters of all bank assets in the country.

Like growing income inequality, the consolidation of the banking industry has been under-way since the 1980s. But the financial crisis and its aftermath exacerbated the trend, as policymakers encouraged stronger banks to swallow up weaker ones. Wells Fargo bought Wachovia, Bank of America took over Countrywide and Merrill Lynch, and JPMorgan Chase bought Bear Stearns, to name a few big mergers. Between the end of 2009 and 2013, the number of banks shrunk 17 percent, to 6,812, the lowest level since banks were first tracked in 1934, according to the Federal Deposit Insurance Corp. During that same period, total bank assets grew 12 percent.

The top two banks alone, JPMorgan Chase and Bank of America, control a quarter of all bank assets. If Jamie Dimon, CEO of JPMorgan Chase, or Brian Moynihan, head of Bank of America, makes a dumb decision (how could that ever happen?), the whole industry could feel the effects.

Perhaps it should come as no surprise that while fewer banks control more assets, bank profits have been better than ever. Last year, overall bank profits increased 10 percent to $155 billion, a record for the industry and the fourth straight year of increases.

None of this especially displeases regulators. The industry's minders have condoned the trend of fewer lenders making more profit and controlling a larger share of the banking system. And they assure us that our banks are in good shape now. The real unknown is whether the rest of us will benefit. So far, those fat bank profits haven't translated into rapid job gains or a booming economy. Nor have ATM fees, account fees and credit card fees fallen-not that anyone was banking on that happening.