The IRS will distribute another round of the expanded Child Tax Credit payments on Friday, with two more installments left this year.

Part of the America Rescue Plan passed by Congress in March, the credit is aimed at helping families pay for essentials as the country's economy recovers from the coronavirus pandemic.

Half of the credit paid out from July to December sees qualifying parents receive a check worth one-twelfth of the overall payment. The other half of the credit can be claimed as a lump sum on one's taxes in April 2022.

In what will be the fourth of six monthly payments, the next sum will go out on October 15 by direct deposit and through the mail. The final two payments for 2021 are due November 15 and December 15.

Households that are still waiting for one of the three monthly checks that have already been sent could see an adjusted, higher payment on Friday.

So far there have been some reports of problems with payments including missing checks, incorrect amounts and outdated IRS information, CNET reported.

Around 15 percent of families that got July's payment by direct deposit were posted paper checks the following month because of a technical issue.

While it is too late to do so for October, one option for those households to consider is to unenroll altogether from the remaining checks for the year.

Those with complicated tax or family situations or parents who may just want to get a bigger amount next year, might also want to opt out for next month and would need to do so by the deadline of November 1.

In September, around 35 million American households received the tax credit, which was worth up to $300 per qualifying child under the age of 6 or a total of $3,600.

They could also get up to $250 per qualifying child between 6 and 17 years, or a total of $3,000.

Single filers earning less than $75,000 annually, heads of households on less than $112,500 and married couples earning less than $150,000 can get the full amount. It then phases out by $50 for every $1,000 of income above those threshold amounts, according to CNET.

One Columbia University study in August said that the child tax credit kept three million children out of poverty in July.

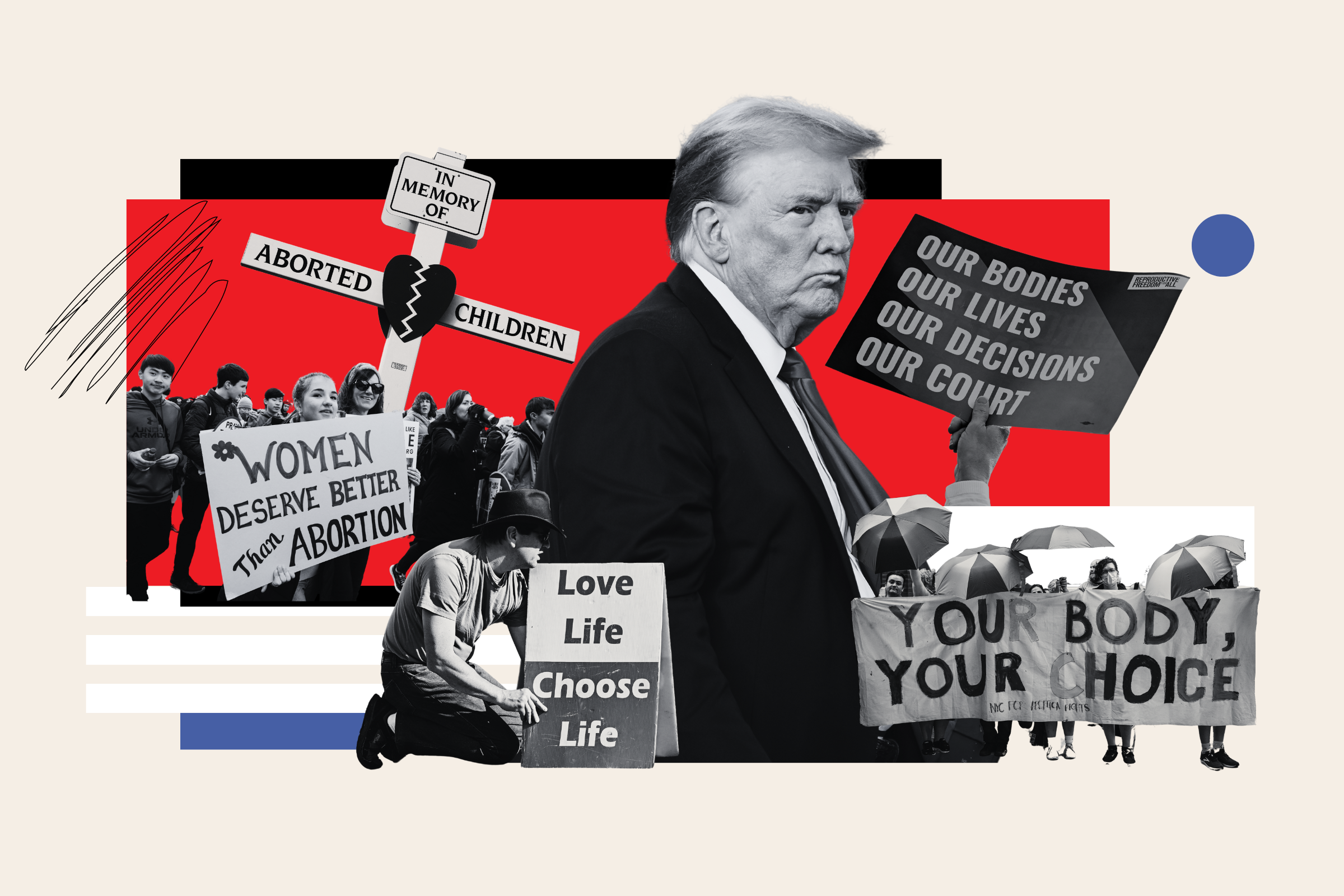

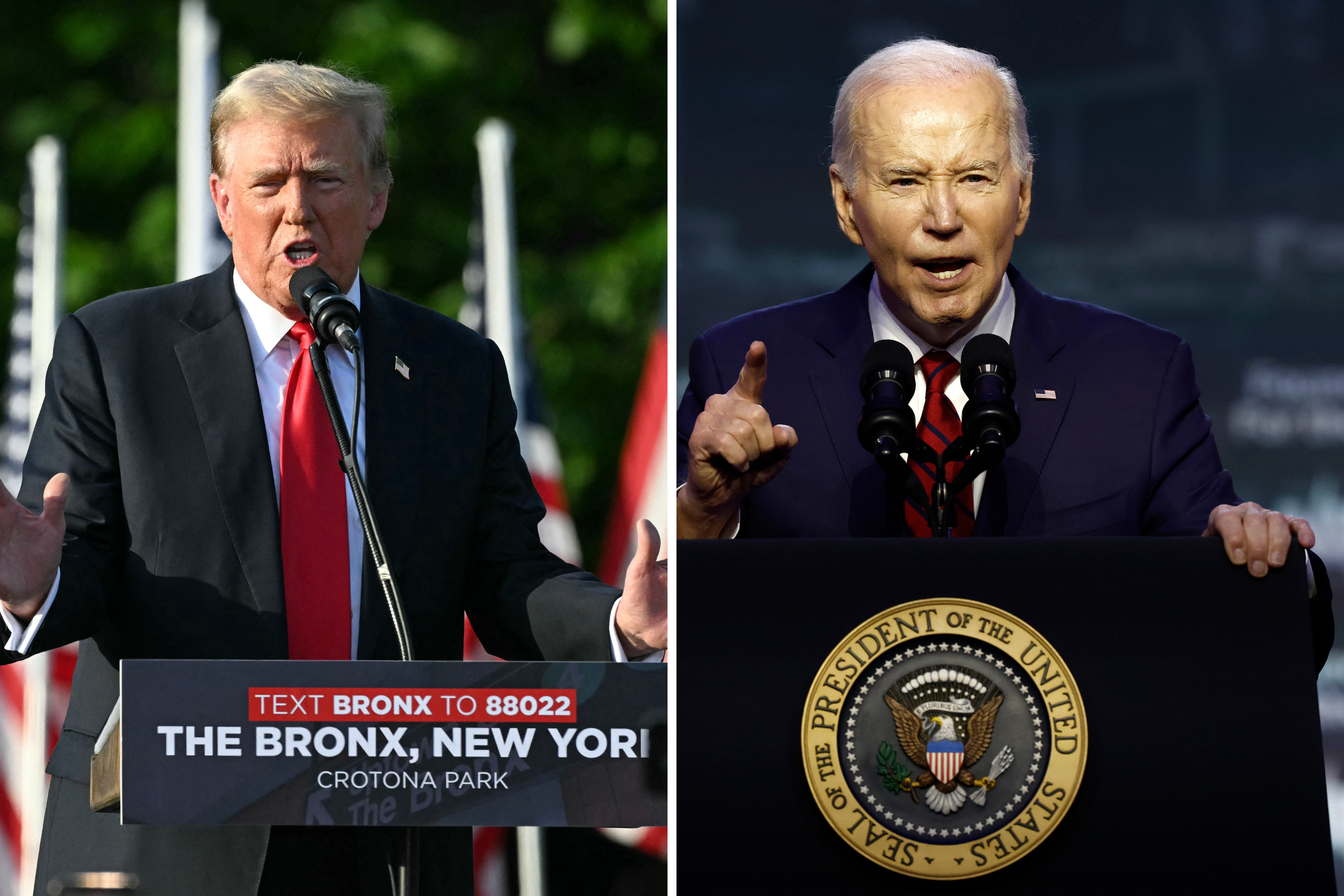

While popular, the payments end in December unless they are extended. They face GOP opposition.

This poses a problem for Democrats, who are both fighting to maintain them and concerned about the impact their cessation would have on the party during the 2022 midterm elections.

The tax credits would be extended through the Democrats' $3.5 trillion budget reconciliation proposal.

"The idea of letting it expire, I think, would be horrific," Rep. Jim McGovern, D-Mass., said.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Brendan Cole is a Newsweek Senior News Reporter based in London, UK. His focus is Russia and Ukraine, in particular ... Read more