Arbitrage, Nicholas Jarecki's ambitious new film about a financial tycoon juggling various forms of fraud, hits theaters in September. When it does, expect a flurry of articles, blog posts, and furious tweets pointing out its absurdities. Technical terms are ferociously abused. A sizable merger deal is inked with less paperwork than my last auto loan. The film's protagonist pulls off a financial caper that would not have lasted five minutes in real life, and most annoyingly, no arbitrage is featured. All this and more will be pulled apart by anyone who knows anything about how the financial system works.

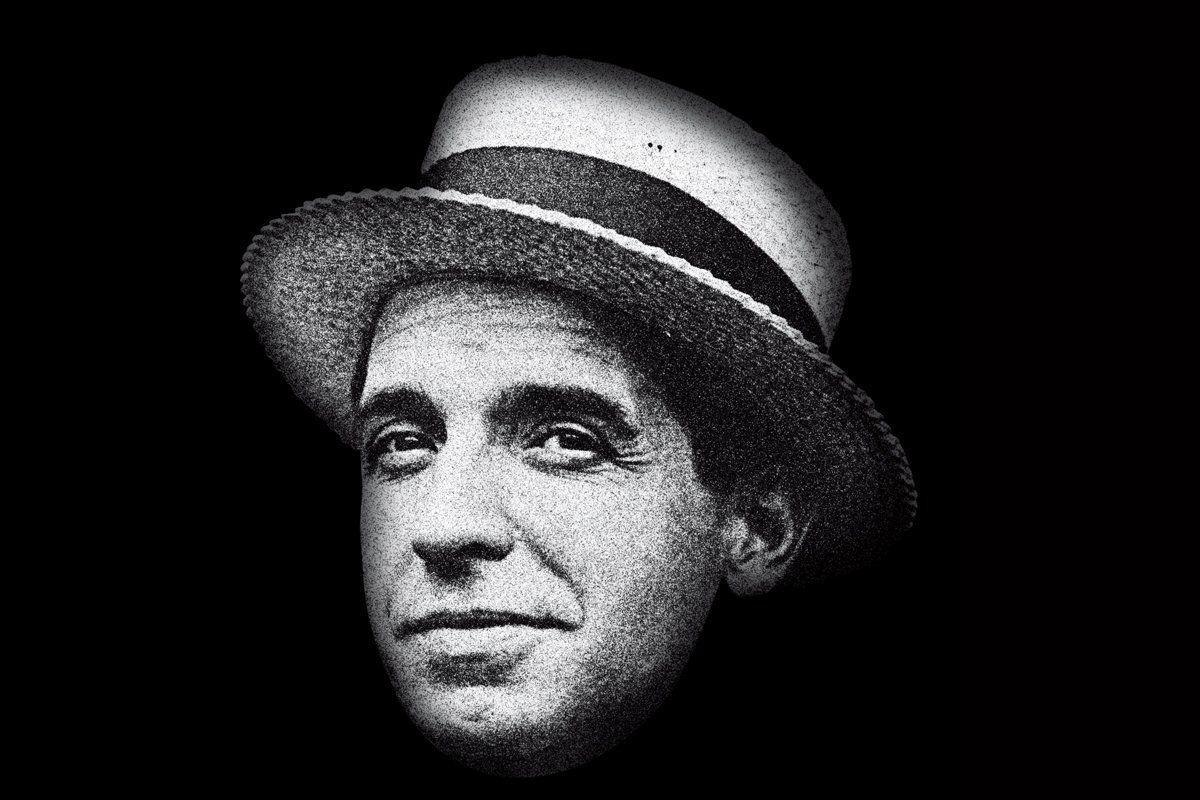

For all the things it gets wrong about Wall Street, it's a perfectly pleasant way to pass a couple of hours. Richard Gere has just the right level of charm and self-absorption as the white-maned patriarch of a financial dynasty. He captures the essence of the really successful con man, which is the ability not only to make people like you, but also to (almost) believe your own lies.

And that points to one thing the film gets very right: fraudsters and Ponzi schemers do not succeed at their scams merely because we let them. Recent financial frauds have big dollar signs attached, but at their heart, they're often not much different from Nigerian email scams or a three-card monte game. They work best when they let the mark believe he's getting away with something—often something illegal, or at least dishonest. It's an old saw that "you can't cheat an honest man," but it's mostly true. We are most vulnerable to Ponzi schemes and other confidence tricks when we start to believe that we can cheat the universe—that we can get something for nothing. The best con men succeed mostly because we are so desperate to believe them.

Even spectacular cases of financial fraud usually turn out to be remarkably banal in their execution. Embezzling grotesque sums rarely seems to require dazzling financial wizardry; all it takes is some basic clerical skills and a willingness to deceive.

After Peregrine Financial imploded last July, the firm's president, Russell Wasendorf, confessed in a note related to a botched suicide attempt how he had misappropriated what seems to be more than half of his clients' funds. The fraud was breathtaking in its audacity, and its simplicity: Wasendorf had been intercepting the bank statements and counterfeiting new ones using Photoshop and Excel. When auditors and regulators started confirming balances with banks, Wasendorf opened a P.O. box and put the address on the fake bank statements. When regulators started looking at online banking statements, he learned to fake those, too.

Bernie Madoff's strategy wasn't much more technically sophisticated than Wasendorf's. And yet it seems to have been going on since at least the late 1980s, in large part because Madoff's investors wanted an essentially guaranteed return of more than three times the annual rate of U.S. economic growth. They wanted, in short, to make quite a lot of money without working.

The essence of the Ponzi scheme is the promise of profit without effort or risk. Like Madoff, Charles Ponzi had a plausible-sounding means of generating money for his "investors": arbitrage of international reply coupons. Little used today, IRCs are sort of like gift cards for postage stamps; you can send them to people in another country to allow them to purchase enough postage to mail something back to you.

The chaos following World War I produced pricing anomalies: IRCs purchased in many foreign countries cost less than their redemption value in the United States. Boston swindler Charles Ponzi told investors that he could exploit this to make high, guaranteed returns. That's all his investors needed to hear; Ponzi raked in millions in the space of a few months. Eventually, of course, someone noticed that there were not enough IRCs in the system to be generating the returns Ponzi was claiming, and the scheme collapsed.

Like such notorious schemers as Dona Branca, Marc Stuart Dreier, Sergei Mavrodi, and Reed Slatkin, Madoff managed to stave off questions for somewhat longer than Ponzi himself. Using a not-very-sophisticated custom computer program, a couple of clerks were able to print off statements showing ... well, whatever Bernie Madoff told them the statement should show. When a concerned investor wanted to see how the system worked, he demonstrated fake "trades," where the other party was actually a Madoff employee in another room.

When the whole thing blew up, lots of people asked how it could have gone on so long without anyone noticing. But it quickly emerged that lots of people had. Investors who actually did serious due diligence usually seem to have decided that something was seriously wrong. They thought it was strange that Madoff had chosen an auditor who worked out of a 13- by 18-foot storefront in a Rockland County strip mall. Moreover, they didn't think any trading strategy could produce the returns Madoff said he was getting: 8 to 12 percent every single year, whether the market was up or down. That's considerably better than the S&P 500, and people who invest in the S&P 500 have to accept that sometimes their portfolio drops quite a bit. It's a nearly iron law of finance that you can have high returns, or you can have safe returns, but you can't have both.

When Harry Markopolos, an investment officer at a rival firm, was asked to duplicate Madoff's strategy in the hopes of stealing his clients, it took him just a few hours to determine two things: first, that Madoff's strategy couldn't possibly generate the returns he was claiming, and second, that the only thing that could generate them was fraud.

Madoff's victims certainly didn't give the books a closer look, in part because Madoff discouraged the ones who asked a lot of questions. As The Economist wrote shortly after the scandal broke, his customers accepted that "to ask Bernie to reveal his strategy would be as crass as demanding to see Coca-Cola's magic formula." Angering Bernie might kill the goose that laid the golden egg; he had tossed a couple of disrespectful clients who got too nosy about how the money was being made. In retrospect, this was brilliant sociopathic manipulation. People didn't question Madoff's absurdly, unrealistically high returns because if they did, they would lose their shot at making that risk-free 10 percent a year.

When money without effort seems within our reach, we don't require much of a rationale to believe. And we aren't necessarily too picky about the rationale, either. In 1996 a Ponzi-scheme craze swept the nation of Albania so thoroughly that within a year two thirds of the country had invested in one pyramid scheme or another. The inevitable collapse was horrific. According to the International Monetary Fund, "there was uncontained rioting, the government fell, and the country descended into anarchy and a near civil war in which some 2,000 people were killed."

Shortly after the collapse, writer P.J. O'Rourke went to Albania and interviewed people who had participated. How had they been taken in? Similar pyramids had, after all, already come and gone in Russia. A local newspaper editor explained it to him. "People did not believe these were real pyramid schemes," the editor said. "They knew so much money could not be made honestly. They thought there was smuggling and money laundering involved to make these great profits."

Just like those Albanians, some of Madoff's investors seem to have understood that his purported strategy couldn't generate the returns he was claiming. So why did they invest? Perhaps because, as O'Rourke notes of the Albanians, they didn't believe they were the victims of a scam; they thought they were the perpetrators.

It's easy to feel superior to crazy Albanians or Madoff's dupes, but I'm not really sure you and I have been that much smarter. Look at the succession of bubbles over the past 20 years as people have desperately convinced themselves that there is a surefire way to get rich without working... or at the very least, to work for 30 to 40 years, save 5 percent of their income, and then spend 25 or 30 more years in an equally comfortable retirement. A few thousand invested in dotcom stocks was supposed to metastasize into a fortune large enough to retire at 45. The housing bubble that came afterward was even better: you didn't even have to divert money into savings! You could enjoy granite countertops, whirlpool baths, and built-in surround-sound systems right now, secure in the knowledge that while you sat on the deck and sipped Chablis, your house was topping up the retirement fund.

And now? We tell ourselves we are no longer chasing speculative returns; we're going to tuck 8 percent of our salary into a 401(k) and settle for that safe 8 percent return that we're told to expect from a good diversified index fund. But why do we believe in that 8 percent? Sure, that's what the historical returns have been over long periods. But as stock prospectuses always say, past performance is no guarantee of future results.

The 401(k) I started in the late 1990s, before I went to business school, is worth less than the money I put into it. And even when I look at the last decade, I don't see 8 percent growth; after inflation, it's more like 2 to 3 percent. Most of the money in my retirement accounts is the money I put in. Nor am I alone.

All over the country, people are spinning dreams that the 1990s will somehow repeat themselves. How else to explain the crazy hype surrounding Groupon, a company that basically consists of an email list? When we're not buying into (and then getting burned by) the latest IPO, we're desperately trying to figure out how we can retire without the 8 percent annual return we were counting on.

The answer is probably that we can't—or rather, that we never could. By the time I retire, according to government actuarial tables, there are supposed to be two workers supporting each retiree in decades of leisure. There was no financial vehicle that was ever going to make that possible: not the Social Security system, not a gold-plated company pension, not a 401(k), and not a magical money manager promising risk-free returns. And yet whom do we elect? Whose books do we buy? The people who tell us that they can make this impossible thing happen. We've become our own three-card monte dealer.

Arbitrage has been called an anti-morality tale. The big reveal is that all of the characters are complicit, one way or another, for reasons that are simultaneously transparently self-serving and all too realistic. The audience, too, is sucked in. We root for Richard Gere's character to pull it off: to sell the company, make investors whole, keep a little something for himself. And maybe the reason we're rooting so hard is that we, too, are still hoping we can keep the con going long enough to get rich.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

To read how Newsweek uses AI as a newsroom tool, Click here.