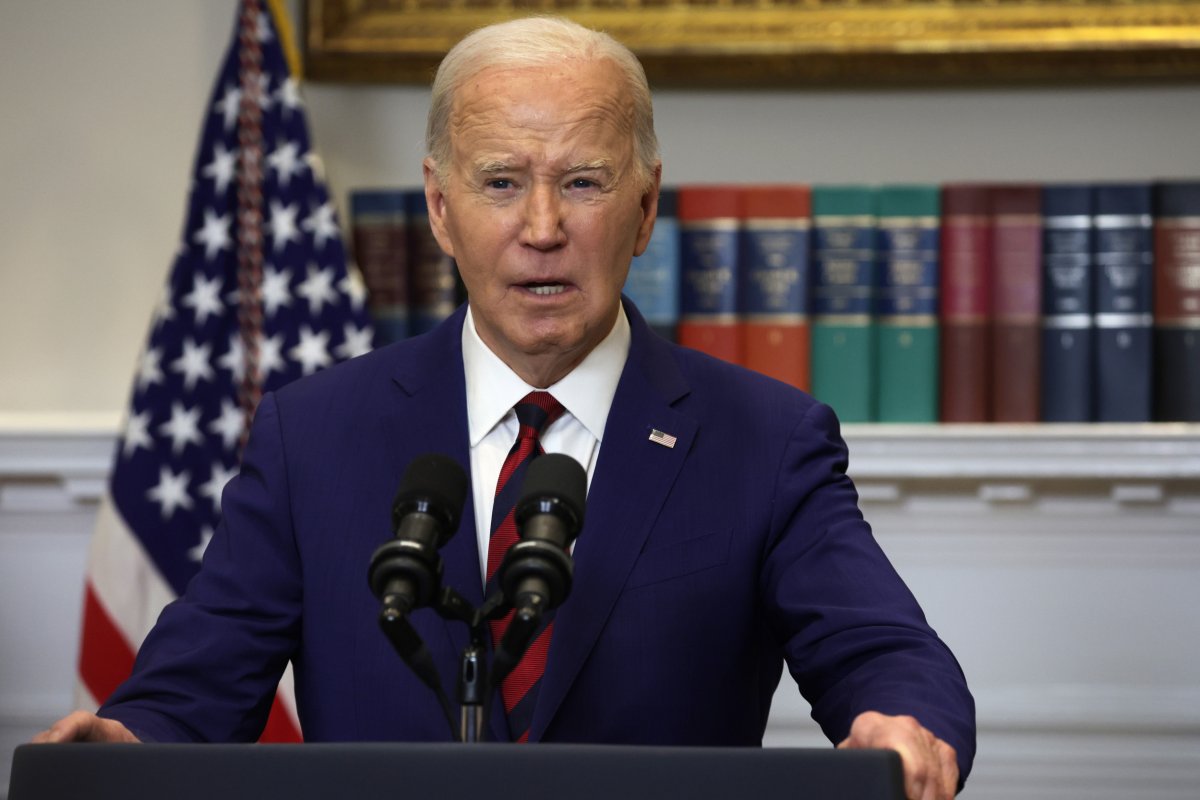

President Joe Biden has unveiled additional plans for student loan forgiveness that could provide relief on federal education debts for 30 million Americans.

New plans announced by the White House on Monday expand on the Biden administration's ongoing plans to push down the level of collective student debt nationwide. That currently stands at $1.6 trillion, according to the most recent data collected by the Federal National Reserve.

The announcement is part of Biden's renewed push to broaden federal student loan forgiveness and affordability in the run-up to the 2024 presidential election. In June last year, the Supreme Court struck down his initial plan, a $400 billion proposal to cancel or reduce student loan debts that a majority of justices said required congressional approval.

Read more: When Is the FAFSA Deadline?

The plans expand on and provide more detailed specifics of who is eligible for loan forgiveness or relief, including the following:

- Those who are already eligible for forgiveness under an existing program but are yet to apply. The plans would automatically cancel debt for borrowers otherwise eligible for relief through the Saving on Valuable Education (SAVE) plan, Public Service Loan Forgiveness, or other forgiveness opportunities but who have not successfully applied for that assistance due to paperwork requirements, bad advice, or "other obstacles."

- Those with "runaway interest" - canceling up to $20,000 of the amount a borrower's balance has grown due to unpaid interest on their loans after entering repayment, regardless of their income.

- Those experiencing financial hardship.

- Canceling student debt altogether for borrowers who enrolled in "low-financial-value programs," which would apply to those who took loans out for institutions or programs that have lost their eligibility to participate in the federal student aid program or were denied recertification because they "cheated or took advantage of students."

"These historic steps reflect President Biden's determination that we cannot allow student debt to leave students worse off than before they went to college," U.S. Undersecretary of Education James Kvaal said in a statement. Newsweek has contacted the White House for comment via email outside of normal working hours.

The president will share additional details on the plans during a visit to Madison, Wisconsin, home to the University of Madison-Wisconsin, today, the White House has confirmed.

The updated plans are an attempt to survive likely legal challenges that saw Biden's previous plans laid to waste. The Department for Education is using the Higher Education Act (HEA) as its justification for enacting the latest plans, whereas the former plan was based on the post-9/11 Heroes Act. Under the Heroes Act, the president has the authority to revise student loan programs during times of national emergency—in this case, the coronavirus pandemic.

If successful, it would have seen eligible debts canceled through executive action, which the Supreme Court took issue with. Under the HEA, the government must use the legislative process to bring its plans to fruition.

"While Republican elected officials try every which way to block millions of their own constituents from receiving student debt cancellation, President Biden has vowed to use every tool available to cancel student debt for as many borrowers as possible, as quickly as possible," the White House said in a statement issued on April 8.

Already in place across the U.S. is the SAVE plan, which reduces or cancels student debts based on income and family size or how much debt a borrower has left to repay. The Biden administration has said it has "approved $146 billion in student debt relief for 4 million Americans through more than two dozen executive actions."

Other programs also help specific types of borrowers in certain industries or professions. For example, the separate Public Service Loan Forgiveness has already canceled $62.5 billion in student debt for 871,000 public service workers since 2020, according to the White House.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Aliss Higham is a Newsweek reporter based in Glasgow, Scotland. Her focus is reporting on issues across the U.S., including ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.