Under Joe Biden's tax plan, marginal state and local tax (SALT) rates will reach new highs across the country, which could lead to lower investment and companies going bust, conservative think tanks claim.

The Democratic presidential candidate's tax proposal includes an increase of the top individual income tax rate to 39.6 percent and a raising of the corporate tax rate to 28 percent.

President Donald Trump tweeted last week: "Remember, BIDEN is going to raise your taxes at a level never seen before. This will not only be very costly for you, it will destroy our economy, which is coming back very rapidly."

However, nonpartisan think tanks argue only a small percentage of taxpayers will face a tax increase, with mostly high-income households effected, while middle class families are expected to see tax cuts under Biden's proposed policies.

Marginal and Average Tax Rates—here's how they differ

A taxpayer's average tax rate (or effective tax rate) is the share of income that he or she pays in taxes. By contrast, a taxpayer's marginal tax rate is the tax rate imposed on his or her last dollar of income. Taxpayers' average tax rates are lower—usually much lower—than their marginal rates.

Source: The Center on Budget and Policy Priorities (CBPP)

A report earlier this month by the Institute on Taxation and Economic Policy (ITEP), a nonpartisan think tank based in Washington, D.C., noted: "Just 1.9 percent of taxpayers would see a direct tax hike (an increase in either personal income taxes, payroll taxes, or both) if Biden's tax proposals were in effect in 2022. The share of taxpayers affected in each state would vary from a low of 0.6 percent in West Virginia to a high of 3.7 percent in Connecticut."

The ITEP report, which looked at the impact of Biden's proposed personal income tax and payroll tax increases for 2022, included an outline of the "Share of Tax Change" across seven different income groups (ranging from the richest 1 percent to poorest 20 percent in the country).

The report indicated that 97 percent of the tax hike under Biden's tax plan would be paid by the richest 1 percent. Taxes were projected to go up by around $289 billion overall and about $279 billion of that would be for the richest 1 percent, according to the ITEP report.

Speaking to Newsweek, Steve Wamhoff, the director of federal tax policy at ITEP and co-author of the latest ITEP report, said: "In other words, when we look at the taxes that individuals pay directly, we find that Biden would raise them for less than two percent of Americans, and that figure does not vary much by state. Even in the richest states, that figure would not reach even four percent. You would need to be among the lucky few to pay more under Biden's plan."

A report last month by the Penn Wharton Budget Model (PWBM) from the University of Pennsylvania, which was updated on Wednesday, also noted: "Under the Biden tax plan, households with adjusted gross income (AGI) of $400,000 per year or less would not see their taxes increase directly but would see lower investment returns and wages as a result of corporate tax increases.

"Those with AGI at or below $400,000 would see an average decrease in after-tax income of 0.9 percent under the Biden tax plan, compared to a decrease of 17.7 percent for those with AGI above $400,000 (the top 1.5 percent)," according to the report.

Under Biden's tax policies, federal effective marginal tax rates (EMTR) would increase for high-income households, while those below the $400,000 income bracket would not see a change in federal EMTRs, according to the PWBM.

Jason Furman, a nonresident senior fellow at the Peterson Institute for International Economics (PIIE), a nonpartisan think tank based in the capital, told Newsweek: "Joe Biden's tax proposals would cut taxes for middle-class families, mostly those with children, while raising them on households making over $400,000."

Furman noted that generally states with more high-income families, such as New York, Connecticut and California, would face larger tax increases.

Speaking to Newsweek, Gordon Mermin, a senior research associate at the Urban-Brookings Tax Policy Center, a nonpartisan think tank in the capital, explained Biden's tax plan "substantially increases taxes on high income households, both directly through higher income, payroll, and estate taxes, and indirectly through higher corporate income taxes. Consequently, higher income states will bear more burden than other states.

"The plan also cuts taxes for low- and middle-income households by expanding tax credits. The most substantial expansion is the temporary expansion of the child tax credit in 2021 and 2022. So in the near-term, states with more children per capita will see larger tax cuts for low and middle income households," Mermin added.

According to analysis by the Tax Foundation, a right-leaning think tank based in Washington, D.C., combined top marginal SALT rates in the U.S. would be the highest they've been since the 1986 Tax Reform Act, which lowered the top tax rate for individuals from 50 percent to 28 percent.

"In 1986, before the provisions of the Tax Reform Act of 1986 went into effect, seven states and the District of Columbia featured combined top marginal rates higher than California's under the Biden plan, led by New York at a combined 63.9 percent," the think tank noted.

Biden's published tax plan, which does not include the repeal of the SALT deduction cap, would also see "the all-in federal rates" at their highest level since 1981, the think tank claimed.

However, in a blog post on the ITEP website, Wamhoof noted: "The Tax Foundation report points out that the personal income tax and payroll taxes together under Biden's plan could result in a top marginal tax rate for the rich approaching 50 percent.

"The truth is that, of the 1.9 percent who would pay higher taxes under Biden's plan, a smaller fraction would pay at the top marginal rate. Even then, they would pay the top marginal tax rate on just a fraction of their income.

Personal income tax rates would remain the same but taxable income amounting to over $400,000 would be "subject to the higher [tax] rates that applied before the Trump tax law went into effect," Wamhoof noted.

"This means that taxable income above $400,000 could be subject to rates of 33 percent, 35 percent and 39.6 percent. The top rate of 39.6 percent would apply only to taxable income exceeding $450,200 for singles and $506,500 for married couples in 2022, the first year the plan would likely go into effect. If a married couple has taxable income of $507,000 that year, they would pay 39.6 percent on just $500 of their income," he added.

According to a report earlier this month by the Hoover Institution, a right-leaning think tank based in California, the increase in business taxes under Biden's tax plan could drive companies out of business and reduce employment, with an estimated 73 percent of firms expected to face a tax hike.

"Pass-through entities employ more than 40 million workers in the United States, and the fully phased in Biden plan would increase the top tax rate on these entities by more than 25 percent, especially because of the payroll tax increase.

"These affected shares of total employment range from a low of 31 percent in Hawaii to 51 percent in Idaho. Idaho, Montana, and Wyoming would be particularly hard hit, as pass-through businesses provide a majority of employment in each of these states," the report added.

Newsweek has contacted the Biden campaign for comment.

The 2020 presidential election takes place on November 3. Biden was reported to be leading Trump in Wisconsin, Pennsylvania, Michigan, North Carolina, Florida and Arizona—six key states—according to the latest Reuters/Ipsos online polls of likely voters, which were published Tuesday.

Biden had the largest leads in Wisconsin and Michigan, where 52 to 53 percent of likely voters noted they would vote for the former vice president, while 43 to 44 percent said they would vote for Trump.

The polls were each conducted among around 1,000 likely voters and each poll had a credibility interval of four percentage points.

The polls in Wisconsin and Pennsylvania were conducted from October 20 to 26, while in North Carolina, the poll was done from October 21 to 27. Florida's poll was conducted from October 14 to 20 and the poll in Arizona took place from October 14 to 21.

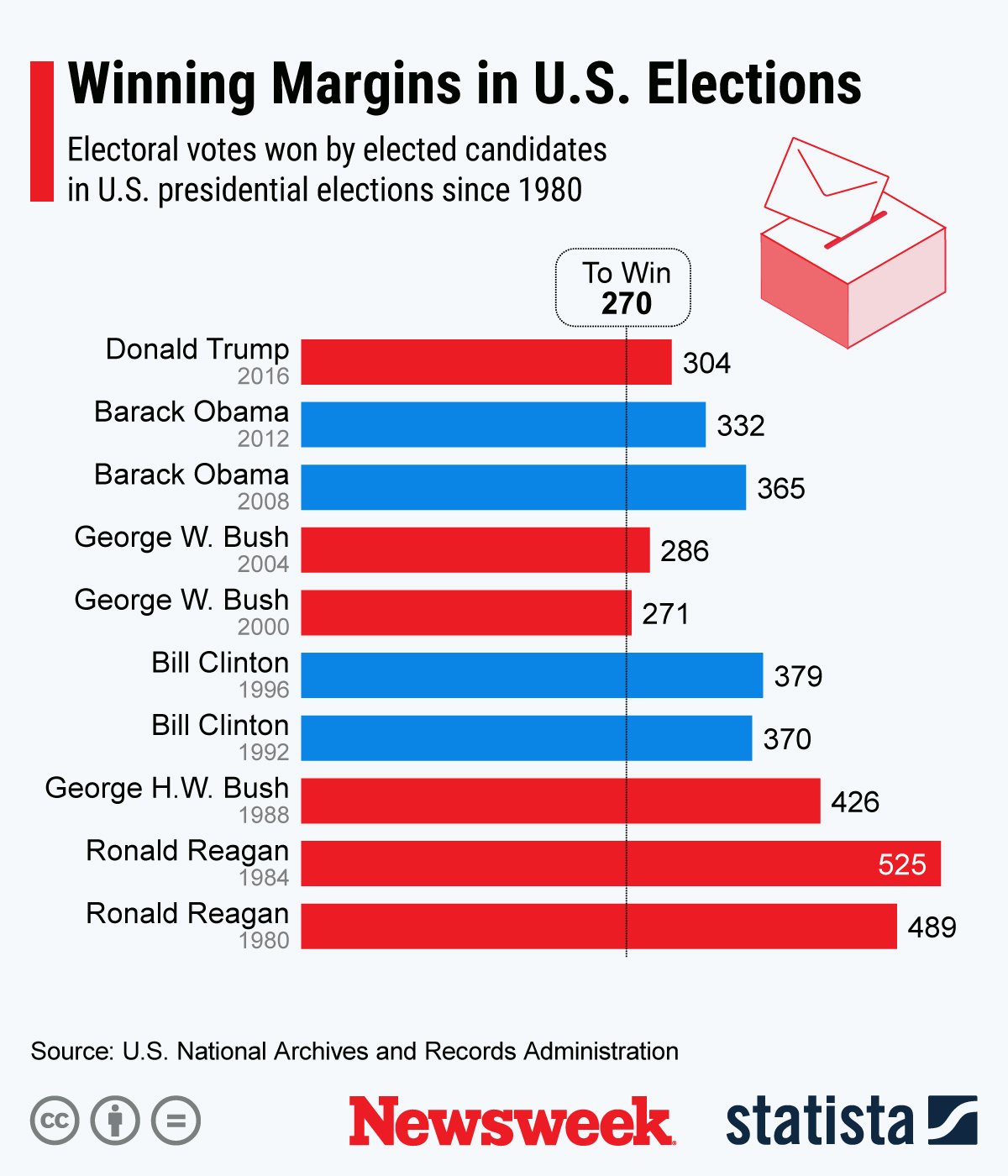

The graphic below, produced by Statista, illustrates winning margins of U.S. presidential elections since 1980.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Soo Kim is a Newsweek reporter based in London, U.K. She covers various lifestyle stories, specializing in travel and health.

Soo ... Read more