It's hard to love America's tax code, which is why millions of Americans put off filing until April 15 - if they file at all. That includes lots of people who don't owe anything and many who will get money back from the government.

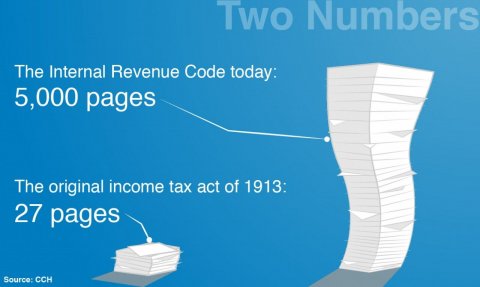

In multitudinous ways, the tax law is perhaps the most complicated feature of life in the United States, and the penalties for getting your filing wrong are serious. What's more, the body of tax law with which all citizens have to comply grows and grows. When Congress passed the income tax act in 1913, it spanned a mere 27 pages. Today, the Internal Revenue Code fills around 5,000 pages.

Yeah, dig in.

If you read the entire code, you don't get a Medal of Honor, but you do learn there's no form 1040, used by around 100 million taxpayers to file individual returns. That's because form 1040 isn't in the code but in the IRS regulations. There are thousands more pages of tax regulations, rulings, guidance, bulletins, forms and summaries of judicial decisions with which we have to comply.

Specialists at CCH, a publisher of guides for tax professionals, have compiled a more or less comprehensive set of documents covering the entire income tax code. So how long is it? According to CCH, it stretches over 75,000 pages in 25 separate volumes. That's a far cry from where things started out back in 1913, when a similar publication covered 400 pages, shorter than most Tom Clancy novels.

It's no wonder that more Americans than ever need help with their taxes. According to the IRS, at least half of Americans use a tax professional or tax-preparation software. And it's costing them both time and money. The IRS estimates the average taxpayer spends about 13 hours doing taxes while the U.S. Treasury estimated tax compliance - in other words, tax deadbeats, cost the United States around $125 billion a year.

And for the record, the King James Bible, War and Peace and both Homer's Iliad and Odyssey books add up to around 4,500 pages.