Shona Pitman grew up in a rough patch of a $2 trillion-dollar island.

Reared in Nicholson Park, a neighborhood in Jersey once so dangerous the school buses took the long way round it, she was acutely aware she did not belong to the island's elite.

Yet she considered herself lucky to be living in a tight-knit community on a chocolate-box seascape, even as material riches transformed her island paradise before her eyes.

"Growing up here used to mean something," she said. "We used to be quite community-spirited. There was a great tourism industry, a lot of employment, farming as well. Finance has come in now. So much is geared toward that, the other industries that were so much a part of our lives are mostly gone."

Born on the island of Jersey, in the Channel Islands, 14 miles off the west coast of France, Pitman knew of no other home than one that answered directly to the queen of England. Neither a part of the United Kingdom, nor the European Union, Jersey is a Crown dependency, meaning it is accountable to the queen, but governs itself.

The island has its own parliament, judiciary and treasury, which prints its own currency stamped with the queen's visage and pegged to the British pound. For purposes of free trade, Jersey is treated as part of the European Union and falls under many of the U.K.'s international treaties and compacts, but it has its own constitutional rights separate from the U.K., tracing back to the year 1204.

In practice, Jersey acts as a sovereign nation that freely grants its loyalty to the queen in exchange for certain special protections, such as the military defense of the island.

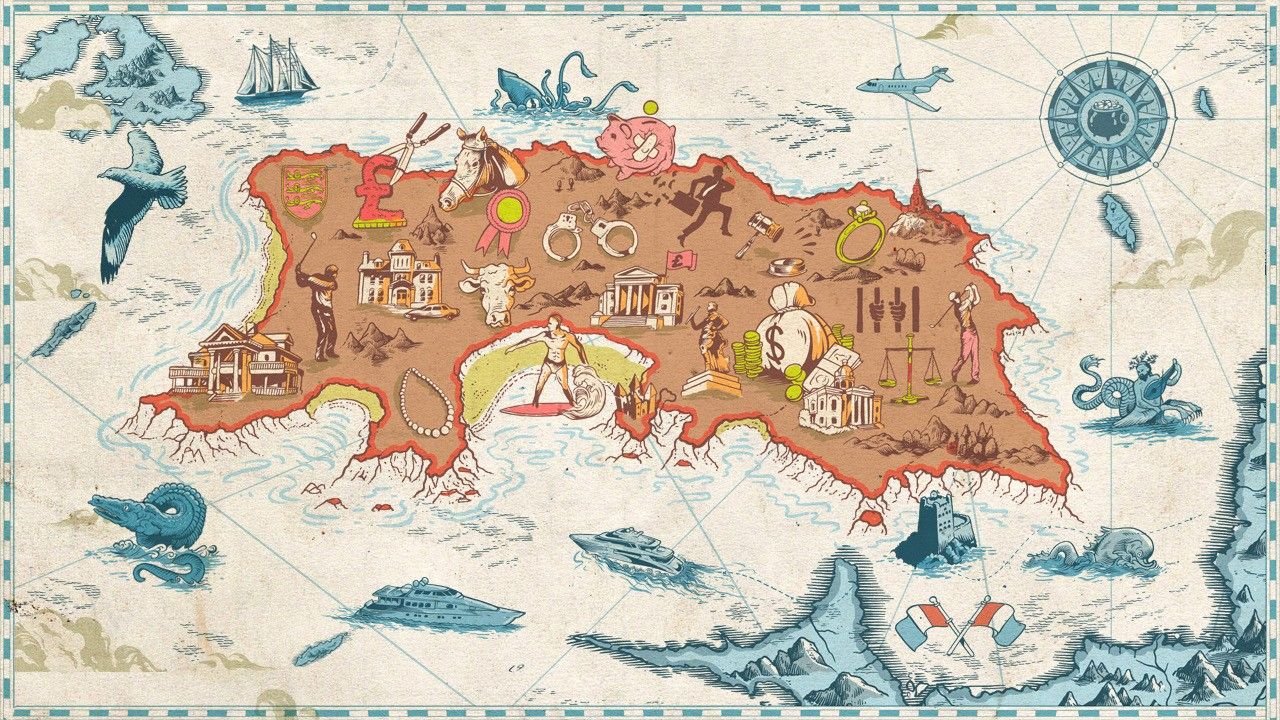

A so-called peculiar possession of the British Crown, Jersey is 45 square miles (about the size of Boston) with a population of around 100,000. The islanders speak English, but due to their close proximity to Normandy, their surnames, buildings and street names are often French. Some islanders still speak the old native tongue of Jèrriais, a Norman dialect.

Jersey's roots stretch back more than a thousand years. A family still living on the island, the de Carterets, once owned the lands that became the state of New Jersey.

The island is known for its history of pirates and Viking invasions, stunning castles, award-winning beaches and seafood, Jersey cows and Jersey cream.

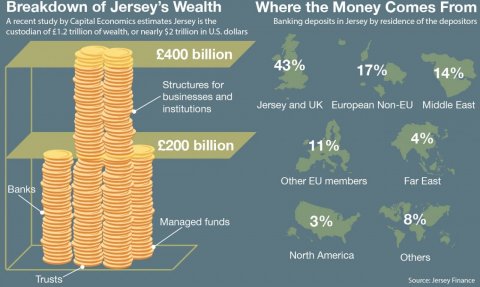

And it is also known for warehousing nearly $2 trillion of the world's wealth.

In 2013, Jersey quietly rose to the top spot of the global rankings of offshore tax shelters, as measured by the Global Financial Centres Index, edging out the Cayman Islands, Monaco, Gibraltar, the British Virgin Islands and Cyprus. Yet because it is so small and tends to shirk publicity, many have never heard of it.

For the uninitiated, a tax shelter is a legal way to minimize or decrease taxable income and, therefore, tax liability. A 401(k) plan is technically a tax shelter, but the legality of some tax-efficient vehicles can be murky, particularly when they are used illicitly to conceal paper trails or earnings for purposes of wrongfully reducing one's tax burden. For its part, Jersey eschews the term tax shelter, preferring international finance center.

Jersey is not much interested in attracting celebrities or press, but the Channel Islands have long been a magnet for big names and banking royalty, such as the Barclay Brothers, British real-estate mogul David Rowland, British Formula One champion Nigel Mansell and Welsh pro golfer Ian Woosnam.

In Jersey, much ink has been spilled over the residency of Scottish entrepreneur and ex-owner of Rangers Football Club, Sir David Murray, and septuagenarian property tycoon David Kirch, who topped last year's London Sunday Times Giving List for passing out £100 holiday shopping vouchers to Jersey's pensioners.

When you fly into Jersey's airport, one of the first things you'll notice is an airfield crowded with private planes. The walk to baggage claim is lined with billboards targeting what Europeans call "Henwees," a term adapted from the acronym HNWIs, for high-net-worth individuals.

The island is encircled by gorgeous beaches, lighthouses, marinas and yachts. The cobblestoned main street that shoots through the island's single town of St. Helier - named for a reclusive holy man martyred by Saxon pirates in 555 A.D. - today is the stomping grounds for an A-to-Z list of bulge-bracket banks (42 of them, at last count) from ABN Amro to UBS. In the warmer months, you'll occasionally see a harpist at the top of King Street, her instrument tilted toward the crowds.

In a brochure containing pictures of Jersey's yacht-filled marinas and the glass-and-steel towers making up St. Helier's downtown financial district, Jersey Finance, the island's nonprofit group representing Jersey's top-grossing industry, boasts the "largest workforce of any offshore financial center," with "innovative arrangements" for a Who's Who of global clientele, including "ultra-high-net-worth" families," investment managers and most of the global banks. The bulk of Jersey's business comes from Britain's financial district, the City of London, but Jersey is increasingly attracting comers from Europe, the Middle East and Asia.

In the third quarter, the latest for which Jersey Finance has statistics, the island reported 667 new companies incorporated, up from the prior period, bringing the grand total to 33,272. That's roughly 740 companies and more than $40 billion of wealth sheltered per square mile on an island otherwise known for its pastoral landscapes, country estates and epic ocean views from each of its 12 parishes that make it a favorite honeymoon island for Brits.

Jersey also has cropped up in headlines for attracting well-heeled clients such as the mammoth Swiss trading firm Glencore Xstrata (of Marc Rich fame) and Brevan Howard Asset Management (one of Europe's largest hedge funds). Both have hung shingles in Jersey in recent years, with a Jersey-based law firm handling Glencore's $10 billion public float in London and Hong Kong.

For many who follow the financial industry, Jersey came into the spotlight when Goldman Sachs trader Fabrice Tourre stated that Jersey-based companies arranged the Abacus deal that made New York hedge fund manager John Paulson billions, and led to Goldman paying half a billion dollars in a settlement with the Securities and Exchange Commission.

In a statement to Newsweek, Jersey's financial regulator, the Jersey Financial Services Commission, stated the case has not yet been settled and interactions with the SEC are "confidential and cannot be disclosed to third parties." It added, "Proceedings in relation to Mr. Fabrice Tourre are ongoing."

Geoff Cook, chief executive officer of Jersey Finance, readily acknowledges that Jersey has been exploited by some in what many consider to be "abusive tax-avoidance" schemes, but he is quick to add that Jersey observes tax information exchange agreements with 33 jurisdictions and is in advanced negotiations to ink around a dozen more.

He also points out that Jersey has come down hard in cases of severe abuse, such as when an associate of former Nigerian dictator General Sani Abacha deposited millions of misappropriated public funds on the island. In response, Jersey's Royal Court ordered the repatriation of the funds and slapped the associate with a six-year prison sentence in February 2011. "Jersey has no desire to host abusive business," he told Newsweek.

Jersey's financial industry now looms so large, it dwarfs every other sector of the island's economy, including its once-thriving agriculture and tourism industries. It generates the lion's share of government revenue.

The idyllic aerial view of Jersey belies what is happening below.

A growing number of islanders, such as Pitman, question whether the price the island has had to pay for its riches is too high. Half those born on the island choose not to live there anymore and voting rates have plummeted as the majority of Jersey's people say they no longer trust the government or the island's judiciary, according to the island's latest annual social survey.

In 2013, the survey highlighted a serious income gap, with 45 percent of islanders stating that they had difficulty paying their bills and only 25 percent reporting confidence in the government.

"It is the strategic aim of the government of Jersey to diversify the island's economy, but it is also important that we continue to evolve and adapt as a well-respected finance center," Jersey Chief Minister Ian Gorst told Newsweek in an emailed statement. (The chief minister is Jersey's de facto president.) "This is something we have been doing for the last 50 years, and I hope we will continue to do it for many years to come."

Exactly one decade ago, Jersey slashed corporate taxes from 20 percent to zero, except for finance, which pays 10 percent. The shortfall left a hole in the island's budget large enough to drive a truck through, according to British author Nicholas Shaxson, who wrote Treasure Islands: Uncovering the Damage of Offshore Banking and Tax Havens (Palgrave MacMillan, 2012). The solution: a tax on consumption that crimped the wallets of Jersey's working class. "It's a tax-the-poor-to-save-the-rich" approach, according to Pitman.

Shaxson's book highlights the view of a wealthy retired property developer living in Jersey: "I pay a quarter in tax terms of what the guy who collects my bins does. I play golf all day, while he probably can't even afford to pay for the house he lives in. Living in Jersey is like that: If you've got the money, you get the cream."

Alas, that's the rub. While Jersey's riches pile up, there is a growing perception among the island's working class that there's one set of rules for the haves and another for the have-nots. Increasingly, high-ranking officials on the island have begun to speak out, stating that the problems go much deeper than class divisions and pervade the island's body politic, parliament, law enforcement and even justice systems.

"An absence of controls" and "absence of accountability" have left "the ordinary, decent people of Jersey helpless," stated Jersey's former deputy chief of police Lenny Harper in an affidavit he submitted before he retired in 2008. This came amid a wave of blistering criticism over his aggressive handling of one of the island's worst-ever scandals: the systemic abuse of children that went largely ignored by his predecessors for decades.

"Local politicians expected a degree of control over day-to-day operations which no police force in the United Kingdom would have tolerated," Harper stated. "Intentionally or not, the system has allowed corruption to flourish to such an extent that those seeking to combat it are the ones open to scorn."

Such contentions seem beyond the pale on an island that gets high marks from the International Monetary Fund and the Organization for Economic Cooperation and Development for its finance industry. But Robert Whitley, a professor of psychiatry at McGill University and Dartmouth College who grew up in Jersey, told Newsweek he believes the island's fierce protectiveness of its financial industry may be part of the reason why there are concerns.

"There's a strong class system, a hierarchy on the island that wants to maintain the status quo. Our global reputation and financial stability seems to offset the search for justice and need for proper checks and balances that are crucial to any civil society. It is a consequence of a concentration of too much power in too few hands, and no authority that ever cares to intervene."

Days after telling the Jersey authorities in 2011 that I had started researching child abuse though I did not have a work visa, I was detained at London's Heathrow Airport for more than 12 hours, accused of deception, thrown out of the country and banned from entering the U.K. or Jersey for the next two years. In a statement to The Guardian, the U.K. Border Agency stated: "Ms. Goodman was refused entry to the U.K. because we were not satisfied she was genuinely seeking entry as a visitor for the limited period she claimed. Further enquires showed that she attempted to mislead the Border Force officer about her travel plans and the reason she required entry to the U.K."

The ban was overturned in 2012, after U.K. Member of Parliament John Hemming, a Liberal Democrat from Birmingham-Yardley, challenged it as politically motivated and unsupported by British law. An unsigned document sent by the U.K. Border Agency to this reporter after legal objections were made stated, "I have reviewed the period of the ban and am satisfied that a period of one year, rather than two, should have been applied."

When Pitman ran for election and won a seat in the States of Jersey, the island's parliament, in 2005, she hoped to bring positive change to Jersey from the inside. She found herself representing the financial district of St. Helier.

Her background did not include finance. An earnest and soft-spoken blonde who entered politics after earning a master's in international peace studies at the University of Bradford in England, Pitman campaigned on social-justice issues, observing that the island's immense prosperity offered a chance at a higher standard of living for all, not just a chosen few.

Pitman's husband, Trevor - also from Nicholson Park - joined her in the States of Jersey in 2008. Together they helped found the Jersey Democratic Alliance, the island's first political party of progressive dissidents.

Encouraged by the States of Jersey Police, nearly 200 people came forward from all parts of the world to report they were victims of child predators on the island, naming more than 151 suspects - 30 of them now dead - according to a press release issued by the States of Jersey Police at the close of the investigation, dubbed Operation Rectangle, in late 2010.

Among the high-profile attackers (who were never apprehended) reported to Jersey police was British disc jockey Jimmy Savile, accused of repeatedly abusing children and fond of traveling to Jersey where, ominously, he regularly visited children in care. Those who have reported him for abuse include both boys and girls who were at a government-run children's home in Jersey, Haut de la Garenne.

During Operation Rectangle, a dig under the home unearthed remains of children ages 6 to 12 years old, according to the press release from Jersey's police, which added "no people are reported missing" and "there are no suspects for murder."

The details of the release have since been contested by many, including Hemming, who begs to differ, stating that a child from his district in the U.K. who was sent to Haut de la Garenne has yet to be located.

The revelations were akin to dropping an H-bomb on the sleepy island. It polarized Jersey's elected leaders, its Crown officers and entire population.

It also raised concerns for the island's economy, which is almost completely reliant on maintaining its polished international reputation as a "solid and stable" financial center. A constitutional review by the island's parliament in 2008 reinforces that, stating: "For the foreseeable future, the economy will remain largely dependent upon the finance industry."

Fewer than a dozen suspects were convicted in Operation Rectangle, sparking widespread outrage from victims and those accused on the island. In an open letter to the island's only newspaper, the Jersey Evening Post, Lindsey Wherry, the wife of an accused predator, noted that without further investigation there would never be clarity in Jersey as to who was innocent and who was guilty. Noting the high number of accused predators and low number of convictions, she asked: "Are they trying to say 143 [alleged] abusers have been let off free?"

During Operation Rectangle, Jersey health minister, Stuart Syvret, and Jersey's two top cops - Harper and his boss, Chief of Police Graham Power - were subjected to smear campaigns by the Jersey Evening Post over their aggressive handling of Operation Rectangle. The paper's owner, Guiton Group, was chaired by Frank Walker until 2005 - when he stepped down to become the island's chief minister. Walker issued a public apology to the victims of abuse on the island, but objected to suspending high-ranking members of Jersey's government who stood accused during the probe.

"When I announced the enquiry, I said that no stone will be left unturned to establish what happened, who was involved and what they did or didn't do," Walker said in a public statement in 2008. "Whatever suggestions and allegations - unsupported by any facts - may be made to the contrary, that remains and will continue to remain the position."

By the time Operation Rectangle wrapped, both Harper and Power had fled the island with their families (both are now living in retirement in the U.K.) and Syvret had been fired in a vote of no confidence and subsequently jailed for refusing to stop publishing allegations of wrongdoing by Jersey officials on his blog. (His most recent prison sentence ended this month.)

According to David Warcup, who took over the investigation in 2008, the island's paucity of convictions stemmed from the fact some suspects were dead and others did not meet "the evidential test."

An official committee of inquiry into Operation Rectangle, approved last spring by the island's parliament and chaired by London-based Bedford Row judge Mary Frances Oldham, is scheduled to start this year solely to put to rest nagging questions about whether the original inquiry was properly held. As such, it is not expected to result in further prosecutions.

Much is at stake, as Cook reports that Jersey's economy supports an estimated 180,000 U.K. jobs, adding that financial companies work closely with the island's leadership to "make sure the strong reputation of the island is maintained."

Said one London-based money manager who opted to base his hedge fund in the Caymans instead of Jersey, "All it takes is a couple hours, some legal fees and the stroke of a pen to move your money from one tax-efficient domain to another. I can't even imagine having a conversation with investors about basing our operations on an island with serious concerns about child abuse."

Looking on, with the Jersey Democratic Alliance having disbanded amid the infighting over the probe, Shona Pitman told Newsweek the number of dissidents brave enough to speak up in the island's parliament has shrunk. "It's in a bad way here," said Pitman. "We have done everything we can to stand up for the people who have been wronged. But it's been very hard. If you speak out, there are a lot of people who will accuse you of being against the island."

Fighting for social justice on the island may get the Pitmans kicked out of office - not because they've lost voter support, but because a Jersey judge earlier this month ordered them to file for bankruptcy after they lost a defamation suit against the Jersey Evening Post and found themselves, on their government salaries, unable to pay the legal costs of all parties involved.

In Jersey, Trevor Pitman says, members of parliament cannot retain their jobs as legislators once they have filed for bankruptcy. "We want to see Jersey as it should be," he told Newsweek. "We don't want to give up on the island, but we have to figure out how we're going to stay here and make a living."

Leah McGrath Goodman was banned from the United Kingdom and the island of Jersey while conducting interviews for this piece. Her ban was lifted in 2012.

Next: the power behind the throne in Jersey and the island's unusual relationship with the British Crown.