When 200 of CGI Federal's top managers gathered at the luxurious Nemacolin Woodlands Resort in southwestern Pennsylvania on a brisk day in early November 2009, they found time for business - and high jinks.

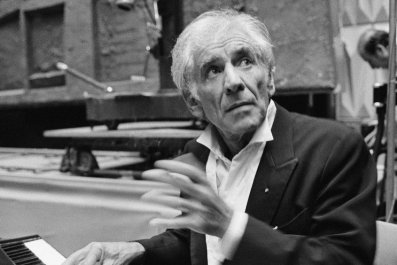

During the two-day event, managers presented PowerPoint slides celebrating the phenomenal success of CGI Federal, a major technology contractor, in winning lucrative government contracts. Most attendees stayed in the resort's Chateau Lafayette hotel, a replica of the Ritz-Carlton in Paris, and at a formal dinner under the elaborate chandelier in the ballroom, George D. Schindler, the president of CGI Federal, spoke of the company's big profits that year and its bright future.

The fun came during a team-building exercise following a boozy lunch in conference rooms not far from the hotel's Lady Luck casino. Managers were split off into small groups and asked to solve math-laden riddles. For each correct answer, they received a bicycle part. The goal was for the teams, around 20 or so, to assemble children's pink and blue bicycles, then race their tasseled bikes up and down the carpeted corridors of the hotel.

"People were riding these bikes drunk through the hallways of the resort," recalls one former manager who attended the event, while others were duckwalking the bikes, which were too small for most adults to sit on. Amid "a lot of hooting and hollering," the manager recalls, the hotel staff was laughing. "Some people were bombed out of their minds until 2 a.m.," he says. "It was greed and opulence, and it was on the taxpayers' dime."

He was wrong about one thing: Taxpayers didn't pay directly for the event for CGI Federal, the American arm of Montreal-based CGI Group that is known these days as the main company behind the glitch-plagued Healthcare.gov website, the engine of the Affordable Care Act. Through a lucrative government contract, CGI Federal is the principal contractor assigned the daunting job of building the federal online insurance marketplace - a large, complex website intended to help millions of ordinary Americans obtain health insurance that instead has become a byword for technological failure.

American taxpayers are among the main drivers of earnings at CGI, whose stock market value is $11.6 billion. For its recently ended fourth quarter, the company's revenue grew nearly 53 percent, to $2.38 billion. That put its total revenue for its fiscal 2013, which ended in September, at more than $9.8 billion, with nearly $442 million in profits.

CGI Federal and its parent company, CGI, do behind-the-scenes work, often with "Top Secret" clearance, for hundreds of American and foreign government agencies - from the U.S. Nuclear Regulatory Commission and State Department to the Kyrgyzstan Border Service and World Anti-Doping Agency. But the questions swirling around the company go beyond how it mangled the showpiece reform of Obama's presidency. Some investors and analysts are expressing concerns about potentially aggressive bookkeeping, weak disclosure practices and corporate governance issues.

In recent months, Deutsche Bank and at least one hedge fund, 683 Capital Management in New York, have been asking if the company is double-counting revenues. Mike Yerashotis, an analyst at Veritas Investment Research, an independent equity research firm in Toronto, writes in recent research notes that investors should have a "healthy degree of skepticism" about CGI's earnings. Yerashotis, a chartered financial analyst, cites a red flag around complex accounting issues, including deferred revenues, contract losses and work in progress.

Other issues predate the Obamacare debacle. In November 2011, a whistle-blower sued the company, claiming that an internal CGI Federal "Rat Pack" planned a "shell-company scheme" designed to get around U.S. Housing and Urban Development restrictions on subcontractors processing federally subsidized low-income housing payments - effectively defrauding the U.S. government. In a 2010 email, a CGI executive drolly dubbed the scheme the "flying nun," a reference to the 1960s television sitcom featuring actress Sally Field as a nun with a shady past. CGI Federal manages more than 25 percent of the nation's Section 8 low-income apartments and houses, earning some $50 million a year from the business.

Wheeling N Dealin

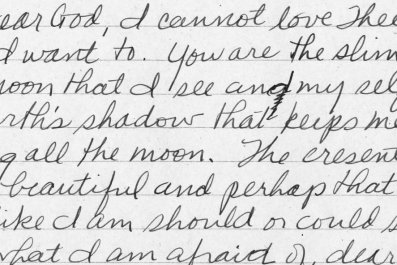

CGI had humble beginnings, and those early years provide some clues as to how CGI Federal ended up getting ripped in headlines for the Obamacare flop.

Established by Serge Godin, now the company's executive board chairman, in Quebec City in 1976, CGI began with small local projects, including a contract for data processing at an Alcan aluminum smelter in Godin's French-speaking hometown of Saguenay, a town of nearly 144,000 residents 285 miles north of Montreal.

The nascent field of information technology was on the verge of booming, and Godin jumped in, expanding CGI's workforce, gobbling up smaller Canadian technology companies and landing contracts with Bell Canada, the National Bank of Canada and Quebec's pension plan.

But Godin, who grew up one of nine children and now owns a champion harness-racing horse named Wheeling N Dealin, had bigger plans. He had long dreamed of jumping the border to get into the lucrative U.S. market. In 2004, after decades of smaller acquisitions of Canadian companies, he got his chance: CGI snapped up a faltering Fairfax, Va.-based technology and consulting company called American Management Systems for $858 million in cash. AMS, eventually renamed CGI Federal, was founded by five former Defense Department officials who had worked under Secretary Robert McNamara during the Kennedy and Johnson administrations.

The deal was a turning point for CGI, doubling its size in the United States overnight. More importantly, it gave CGI - until then generally locked out of bidding on U.S. federal contracts due to U.S. restrictions on foreign contractors - a valuable U.S. subsidiary it could use to court American agencies for business. CGI, whose initials stand for Conseiller en Gestion et Informatique, began using the phrase "Consultants to Government and Industry" in corporate materials.

Riding its self-described "buy and build" strategy - and determined not to be Salieri to the Mozart of Accenture - CGI Group in 2010 bought Stanley Associates, an Arlington, Va.-based contractor to the nation's defense and intelligence agencies. The $1 billion deal doubled again CGI's U.S. operations and made Godin, who owns some 31 million shares in the company, including a majority of CGI's voting stock, a billionaire, according to securities filings. Still, there was a divide between Montreal-based CGI Group and its fast-growing U.S. subsidiary CGI Federal, as the parent company's hands-off approach largely left the growing U.S. subsidiaries to their own devices. "Montreal wasn't really involved in Federal's business," says a former executive.

Godin stepped down as chief executive of CGI Group in 2006, handing the day-to-day responsibilities to Michael E. Roach, but he still wields enormous power over the company, according to current and former insiders.

Former executives say the company still very much reflects his unusual management philosophy. CGI has a slim policy manual and relatively little in-house training for its staff - unusual for a company that now has 69,000 employees across 400 worldwide offices. With a "make your own job" ethos, CGI Group generally does not give employees job descriptions or titles; instead, it dumps their skills into a database and requires employees to find their own projects within the company. As part of that "manage yourself" mandate, CGI doesn't even track sick days, and its three-week "bench policy" requires an employee to find a new project in that time frame or risk being fired. Most employees are identified as "consultants," and are compensated through profit-sharing plans. All that traces back to Godin's favorite saying: "Nobody ever washes a rental car" - if you own it, you will take care of it.

"Everyone is kind of self-employed," says Gordon Divitt, who was a senior executive consultant at CGI in 2007 and, before that, chief information officer at Interac, a Canadian ATM company for which CGI ran technological plumbing. "You've got to manage yourself, which is very unusual at a company this size." Godin, he says, espoused "a philosophical approach, rather than a traditional hierarchical approach."

Many big corporations have "mission statements," essentially feel-good boilerplate outlining their raison d'être. CGI has a "Constitution," with "chapters" laying out "Fundamental Texts." The unusual manifesto-style document, available on CGI's website and referenced in securities filings, extols what the company has long called "The CGI Dream: to create an environment in which we enjoy working together and, as owners, contribute to building a company we can be proud of." "Serge believes CGI is truly unique," says a person close to Godin.

Despite its atypical management philosophy, CGI Federal sought to cultivate a more mainstream image, in line with that of competitors like Accenture, Cap Gemini and IBM's government-contracting division. CGI Federal staffed up on former government managers and executives from the Environmental Protection Agency and other agencies. In 2008, it created the CGI Institute for Collaborative Government - a think tank with policy specialists at George Mason University, Johns Hopkins University and Virginia Tech.

The institute reflects CGI's growing vision of itself as being embedded in the government agencies it serves. Mark Abrahamson, the former executive director of IBM Center who served as an informal consultant to the CGI iteration, says contractors like CGI "get really attached to their mission - they think they're working for the public good and providing a public service." A senior technology executive familiar with CGI puts it more bluntly: "They think they're part of the government."

AMS provided most of the executive and managerial manpower at CGI Federal, which almost overnight had a new book of federal contracts with the Department of Health and Human Services, Los Angeles County and other agencies. At the helm was Schindler and his team - the ardent cyclists at the Nemacolin event. In January, the company promoted Schindler to president of U.S. and Canada for CGI Group, giving him a larger role overseeing CGI Federal within the parent company.

But with its history of botched federal contracts, including a $60 million screwup for the Federal Retirement Thrift Investment Board, the overseer of retirement accounts for 4.6 million current and former federal employees, AMS has also supplied some headaches.

These days, says one insider briefed on the matter, CGI "doesn't want to be associated with the AMS culture." Asked about cultural differences, a CGI Federal spokeswoman said that there weren't any and called both companies "introverted" and "heads down." Asked to elaborate, the spokeswoman pointed to the "lack of advertising" by both companies.

But Peter Bourke, an American consultant who helped the two companies integrate, saw something different. "With the merger, both companies had the interesting challenge of merging two different cultures," he writes in a CGI "case study" on his website.

The Double-Dip Sundae

Last year, CGI got into the Asian and European markets when it acquired Logica plc, an Anglo-Dutch technology firm, for $2.7 billion - its biggest acquisition, one that made it the world's fifth largest information-technology company. Robert Atkinson, president of the Information Technology and Innovation Foundation, a lobbying group, thinks CGI's sights are set even higher: "What they would like to be is a Lockheed Martin - the largest government contractor" in its industry.

Before this deal, most CGI employees were in Canada and the United States, with some in India, but it now had access to many more educated, lower-cost technology workers in Hyderabad and Bangalore.

With CGI's global reach expanding, one Logica business the company jumped into was a Dutch crime-watch service called Burgernet, a "citizen's network" that resembles a neighborhood watch group on technological steroids, with deep ties to the state. In a promotional video for Burgernet, two hoodlums on a red moped on the outskirts of Amsterdam snatch a brown purse from a woman pushing a baby in a stroller. A bystander witnessing the crime whips out his cell phone and calls a special Dutch government center to report the theft. A blond-haired dispatcher quickly texts a "keep-an-eye-out-for-these-guys" message to local shopkeepers and residents, and loops in the police. Calls fly back and forth, as "Pot," a white-coated butcher, and "Mr. Smit," a young man glancing out his apartment window, ring the center to report sightings.

The scenario, set to dramatic, campy music, is a striking example of how CGI, like most federal contractors, views the deep intertwining of business and federal agencies. CGI touts Burgernet (the name has nothing to do with hamburgers-it refers to the Dutch word for citizen) as "a great success," with more than 1.3 million people in 382 cities and towns across the Netherlands signed up.

Logica is a very good business, in other words, but is it as good as CGI says it is?

In the past 15 months, CGI has three times made accounting adjustments to the deal adding up to $1.1 billion, according to an analysis of securities filings by Yerashotis, who covers the company for Veritas Investment Research in Toronto.

The adjustments mean CGI can record an additional $1.1 billion in pretax earnings, from related increases in revenue and decreases in expenses. That is something investors like, because earnings are a key driver of a company's stock price. But Yerashotis, who first flagged the issue last March, argues in a November 14 research note that the economic picture behind CGI's earnings may be different: That the adjustments will not produce a corresponding amount of cold, hard cash - a key metric to the health of corporate earnings.

Yerashotis suggests that while the move appears to be legal, it might make CGI's earnings - and share price - appear stronger than they really are.

In the same research note, Bryan Keane and Ashish Sabadra, equity analysts who cover CGI for Deutsche Bank and have a "sell" rating on the stock, wrote that "we continue to question the quality of the company's earnings," and 683 Capital, a hedge fund in New York, has similar questions, according to a person briefed on the matter. The fund declined to comment.

Skeptical analysts have homed in on increases for accounting purposes regarding money related to contract work Logica has completed but for which it has not yet submitted bills - so-called deferred revenue. Making the increases allows CGI to shrink that liability as Logica gets paid, and record a corresponding increase in income - even though there is no corresponding additional cash coming in from those contracts because Logica already accounted for that revenue prior to its acquisition by CGI. In his research note, Yerashotis flags that gap, noting that over its last fiscal year, CGI's earnings before interest and taxes nearly doubled, while its free cash flow appears to have increased by only 58 percent.

The disconnect could potentially dim prospects for shareholders, who probably know that CGI has never paid a dividend on its stock.

In their report, the Deutsche Banks analysts ask if CGI is effectively "double-counting revenues." Deutsche Bank declined to make Keane or Sabadra available for questions.

None of that seems to worry most equity analysts. In recent weeks, more than a dozen brokerage firms have raised their target price on CGI's stock. Scott Penner, who covers the company for TD Securities and is a chartered financial analyst, has slammed the Veritas and Deutsche Bank analyses. Logica's accounting prior to its acquisition, Penner wrote on September 3, "was clearly a more aggressive way of recognizing revenue...yet Veritas (and now this broker)" - meaning Deutsche Bank - "spins it as CGI being more aggressive."

A spokesperson for Ernst & Young in Montreal, which audits CGI, did not return calls requesting comment.

Asked about the accounting questions, Lorne Gorber, CGI's senior vice president for global communications and investor relations, says doubters "don't know our company. These guys are outliers.... They're looking at complex accounting issues, and investors have to wait and see" as the integration of Logica is completed "and assume the progress we've made will stand for itself."

Rescued by the Flying Nun?

In early 2010, CGI Federal managers in Fairfax, Va., caught wind of some potentially devastating news: HUD, one of its biggest government clients, was considering limiting the number of Section 8 low-income houses and apartments for which any one federal contractor could process payments. The biggest threat was the agency's plan to put out to bid contracts that CGI Federal - and others - already held, and to limit profit margins at winning contractors to 10 percent.

At the time, CGI ran the technology governing payments for 25 percent of the nation's Section 8 stock - 275,000 multifamily houses and apartments. Working with local public housing authorities, as required under HUD rules, CGI Federal had generated up to $50 million a year in fees from processing Section 8 payments and performing annual inspections, among other tasks, and CGI wanted more of that business - as much as three-quarters. At stake amid the HUD limits was $625 million in revenues over four years, according to a confidential April 8, 2010 memo.

Section 8 housing is largely a grim business in blighted urban areas. Nonetheless, CGI Federal's profit margins on the business were large. According to a confidential three-page internal document obtained by Newsweek and dated January 28, 2010, they ran as high as 51.7 percent, more than four times the 10 percent profits cap that HUD wanted. Another worrisome point for CGI Federal: HUD's Inspector General found that some public housing contractors, including those affiliated with CGI Federal, had over-billed the Section 8 program by tens of millions of dollars.

In the face of this threat, some CGI Federal managers came up with an idea. "I don't know whether this is possible or allowable, but can we create new entities for selected jurisdictions that are a joined [sic] venture of a PHA and a CGI subsidiary," wrote Panos Kyprianou, a director of consulting services in CGI in a confidential email dated January 29, 2010 and obtained by Newsweek. "If this holds then we can get away with the unit restrictions as these entities will somehow be independent from CGI."

So, could CGI set up entities it secretly controlled, put public housing authorities in front of them, and then hide behind them when bidding on Section 8 contracts? "In other words," Kyprianou wrote, "can we hide behind a subcontractor?"

CGI already had close ties to some public housing authorities, into which it has effectively embedded its employees. One example: the Oakland branch of California Housing Initiatives Inc. recently listed Andrew Hill of CGI Federal as its contact person on its website. The link has since been removed.

In his email, Kyprianou dubbed the proposal flying nun. "The idea was to use shell companies to do the bidding, get the award and them fold them into CGI," says one former manager. "Our business model was going to be screwed unless we used sleight of hand."

Marybeth Carragher, a CGI vice president of consulting, replied to Kyprianou's email that same day: "I was thinking exactly - well almost exactly - that scenario." She added that she wanted to "mock up a few potential scenarios for working around" the proposed HUD restrictions.

CGI says in a statement that an alleged contracting scheme "never existed; nor was it ever contemplated."

A spokesman for HUD in Washington, D.C., did not return calls requesting comment.

A Man Called HUD

Benjamin Ashmore, a former HUD manager hired by CGI Federal around 2009, alleges that he was fired in 2011 when he objected to behind-the-scenes proposals to skirt HUD restrictions. He filed a whistle-blower lawsuit in late 2011 that asserts CGI Federal devised a "director shell-company scheme" - a front for hiding behind public housing authorities. His lawsuit, which is wending its way through Federal District Court in New York, also alleges that CGI violated Securities and Exchange Commission fraud rules.

CGI Group argues in court papers that no SEC violations are involved because its unit, CGI Federal, is not a publicly traded company, but a judge rejected that argument.

Ashmore's complaint alleges that CGI created an in-house team of managers to address the HUD restrictions. Formally dubbed the "Rapid Action Team," or RAT, the group openly called itself "The Rat Pack" in an undated slide that features photographs of CGI employees next to ones of Frank Sinatra, Sammy Davis Jr. and Hollywoo0d's other original Rat Pack members.

In a statement, CGI Group said that "the alleged contracting scheme that Mr. Ashmore describes never existed; nor was it ever contemplated."

Ashmore, now the founder, president and chairman of the National Family Civil Rights Center, an advocacy group with offices in Washington, D.C., and New York, says that when he left HUD to join CGI, he was "impressed with CGI and excited to join the company. It was like being dazzled by the Emerald City from afar."

He says things turned sour when he saw what he alleges was a shell-company scheme. "Being at CGI was like peering behind the curtain and realizing that the Wizard of Oz was just a charlatan.... Behind the curtain, greed, deception, and profits replaced common sense and ethical obligations to clients."

Asked about Ashmore's lawsuit, Garber says simply, "we'll let the courts do their work - that's what the whistle-blower function is intended to do."