HERBERT ALLISON, who died Sunday at age 69, was that rarest of birds in 21st-century America: a public-minded investment banker. Rather than retire after losing out in the CEO sweepstakes at Merrill Lynch, Allison in 2002 agreed to become the (comparatively) low-salaried head of TIAA-CREF, the giant nonprofit investor that shepherds the retirement accounts of millions of educators and college employees.

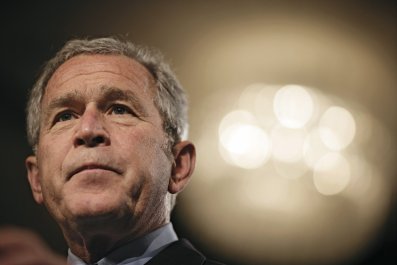

When the financial crisis hit, Allison took the first of a series of thankless government positions, making him the equivalent of a World War II dollar-a-year man. In the fall of 2008, Allison, by then retired, agreed to the Bush administration's request to become CEO of Fannie Mae, the busted mortgage giant that had just become the unwanted property of the federal government. "I felt that saying no was not an option," said Allison, who had served in the Navy in Vietnam. The following spring, when President Obama asked Allison to run the Troubled Asset Relief Program—another hugely unpopular government investment in the financial-services industry—Allison likewise agreed.

The image of the bailouts may not have changed. But the results were generally positive. Under Allison, TARP began the process through which it recouped virtually all the taxpayer funds it had doled out to the stricken financial system. Fannie Mae, which stabilized thanks to the influx of taxpayer funds, is now reliably profitable and returning cash to the Treasury.

But while most Wall Street titans have been unrepentant (see: Dimon, Jamie) and saw the 2008 crisis as a mere blip, Allison was clearly affected by the near-death experience of the system. The lifelong Wall Streeter became convinced that the sector was too big for its own good. In 2011 Allison penned an e-book, The Megabanks Mess, in which he calmly laid out a program to reduce the influence and size of the largest financial institutions.