When President-elect Obama came to Washington in late 2008, he was outspoken about the need for an economic stimulus to revive a struggling economy. He wanted billions of dollars spent on "shovel-ready projects" to build roads; billions more for developing alternative-energy projects; and additional billions for expanding broadband Internet access and creating a "smart grid" for energy consumption. After he was sworn in as president, he proclaimed that taxpayer money would assuredly not be doled out to political friends. "Decisions about how Recovery Act dollars are spent will be based on the merits," he said, referring to the American Recovery and Reinvestment Act of 2009. "Let me repeat that: decisions about how recovery money will be spent will be based on the merits. They will not be made as a way of doing favors for lobbyists."

Really?

It would take an entire book to analyze every single grant and government-backed loan doled out since Barack Obama became president. But an examination of grants and guaranteed loans offered by just one stimulus program run by the Department of Energy, for alternative-energy projects, is stunning. The so-called 1705 Loan Guarantee Program and the 1603 Grant Program channeled billions of dollars to all sorts of energy companies. The grants were earmarked for alternative-fuel and green-power projects, so it would not be a surprise to learn that those industries were led by liberals. Furthermore, these were highly competitive grant and loan programs—not usually a hallmark of cronyism. Often fewer than 10 percent of applicants were deemed worthy.

Nevertheless, a large proportion of the winners were companies with Obama-campaign connections. Indeed, at least 10 members of Obama's finance committee and more than a dozen of his campaign bundlers were big winners in getting your money. At the same time, several politicians who supported Obama managed to strike gold by launching alternative-energy companies and obtaining grants. How much did they get? According to the Department of Energy's own numbers ... a lot. In the 1705 government-backed-loan program, for example, $16.4 billion of the $20.5 billion in loans granted as of Sept. 15 went to companies either run by or primarily owned by Obama financial backers—individuals who were bundlers, members of Obama's National Finance Committee, or large donors to the Democratic Party. The grant and guaranteed-loan recipients were early backers of Obama before he ran for president, people who continued to give to his campaigns and exclusively to the Democratic Party in the years leading up to 2008. Their political largesse is probably the best investment they ever made in alternative energy. It brought them returns many times over.

These government grants and loan guarantees not only provided access to taxpayer capital. They also served as a seal of approval from the federal government. Taxpayer money creates what investors call a "halo effect," in which a young, unprofitable company is suddenly seen to have a glowing future. The plan is simple. Invest some money, secure taxpayer grants and loans, go public, and then cash out. In just one small example, a company called Amyris Biotechnologies received a $24 million DOE grant to build a pilot plant to use altered yeast to turn sugar into hydrocarbons. The investors included several Obama bundlers and fundraisers. With federal money in hand, Amyris went public with an IPO the following year, raising $85 million. Kleiner Perkins, a firm that boasts Obama financier John Doerr and former vice president Al Gore as partners, found its $16 million investment was now worth $69 million. It's not clear how the other investors did. Amyris continues to lose money. Meanwhile, the $24 million grant created 40 jobs, according to the government website recovery.gov.

One might think that the Department of Energy's Loan Program Office, which has doled out billions in taxpayer-guaranteed loans, would be directed by a dedicated scientist or engineer. Or perhaps a civil servant with considerable financial knowledge. Instead, the department's loan and grant programs are run by partisans who were responsible for raising money during the Obama campaign from the same people who later came to seek government loans and grants. Steve Spinner, who served on the Obama campaign's National Finance Committee and was a bundler himself, was the campaign's "liaison to Silicon Valley." His responsibilities included fundraising, recruiting more bundlers, and managing Obama's relationship with a cadre of very wealthy donors. After the 2008 campaign, Spinner joined the Department of Energy as the "chief strategic operations officer" for the loan programs. A lot of the money he helped hand out went to that same cadre of wealthy Silicon Valley campaign donors. He also sat on the White House Business Council, which is made up of Obama-supporting corporate executives.

Another Obama fundraiser positioned to lead the allocation of taxpayer money to Obama contributors was Sanjay Wagle, who served as the managing co-chairman of Cleantech & Green Business Leaders for Obama. Wagle's day job was as a principal at VantagePoint Venture Partners. After the 2008 election, Wagle joined the Obama administration as a "renewable energy grants adviser" at the Department of Energy. VantagePoint owned firms that would later see federal loan guarantees roll in.

Jonathan Silver, who would serve as director of the loan programs, had worked in the Clinton administration, first as counselor to the secretary of the interior and later as assistant deputy secretary in the Department of Commerce. Silver's wife has served as financial director of the Democratic Leadership Council. His business partner, Tom Wheeler, was an Obama bundler, and Wheeler's wife was an outreach coordinator for the campaign. Silver's "strategic adviser" was Steve Spinner.

The grants themselves originated in the office of Cathy Zoi, who served as the assistant secretary of energy for efficiency and renewable energy. (Wagle was her adviser.) Zoi had previously worked in the Clinton White House as the chief of staff on environmental policy, then as the CEO of Al Gore's Alliance for Climate Protection. You may be thinking, "So what? Why would we expect anything less of political appointees?" But the numbers don't lie: the recipients of loans and grants were, overwhelmingly, Obama cronies.

The Government Accountability Office has been highly critical of the way guaranteed loans and grants were doled out by the Department of Energy, complaining that the process appears "arbitrary" and lacks transparency. In March 2011, for example, the GAO examined the first 18 loans that were approved and found that none were properly documented. It also noted that officials "did not always record the results of analysis" of these applications. A loan program for electric cars, for example, "lacks performance measures." No notes were kept during the review process, so it is difficult to determine how loan decisions were made. The GAO further declared that the Department of Energy "had treated applicants inconsistently in the application review process, favoring some applicants and disadvantaging others." The Department of Energy's inspector general, Gregory Friedman, who was not a political appointee, chastised the alternative-energy loan and grant programs for their absence of "sufficient transparency and accountability." He has testified that contracts have been steered to "friends and family."

Friends indeed. These programs might be the greatest—and most expensive—example of crony capitalism in American history. Tens of billions of dollars went to firms controlled or owned by fundraisers, bundlers, and political allies, many of whom—surprise!—are now raising money for Obama again.

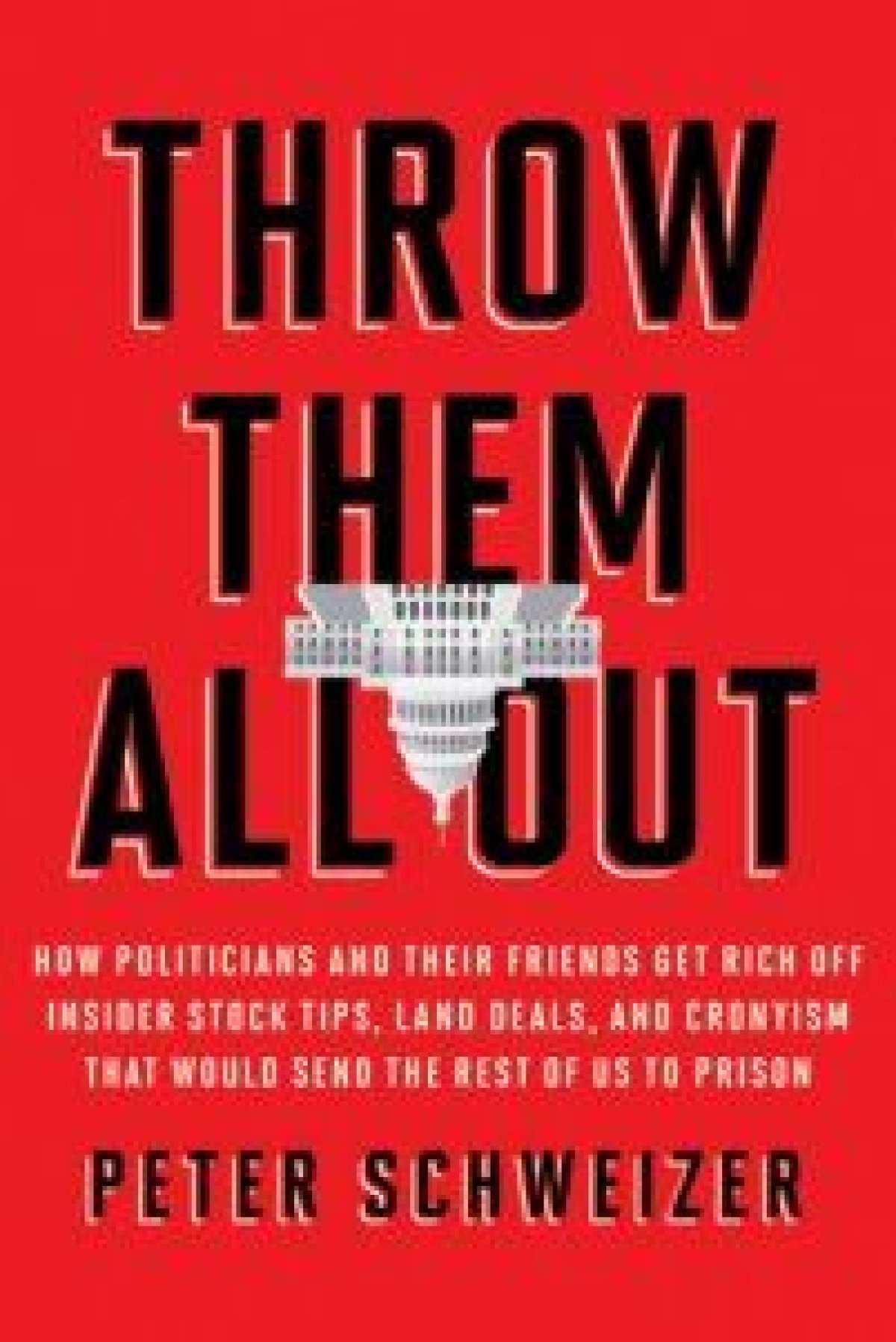

Excerpted from the book Throw Them All Out: How Politicians and Their Friends Get Rich Off Insider Stock Tips, Land Deals, and Cronyism That Would Send the Rest of Us to Prison. © 2011 by Peter Schweizer. Reprinted by permission of Houghton Mifflin Harcourt Publishing Company. All rights reserved.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

To read how Newsweek uses AI as a newsroom tool, Click here.